22+ mortgage lock in rate

Web A mortgage rate lock sometimes called rate protection allows you to keep the interest rate on your home loan from rising between the time you apply for a. Youre not able to lock in a rate until youve received an offer.

Usda Rural Development Home Loan Guide Top Rated Local Buildbuyrefi Home Loan Experts 1 Construction Renovation Cash Out Purchase Loan Experts Buildbuyrefi Com

A reverse mortgage gives you the power to unlock your homes equity while you live in it.

. Web A mortgage rate lock is an agreement between you and your lender to temporarily lock your interest rate for a specific period of time typically 30 to 90 days. Web 15-year fixed mortgage rate. Web At 30 percent a 30-year fixed-rate mortgage will cost 1897 per month not including taxes and insurance.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Get Instantly Matched With Your Ideal Mortgage Loan Lender.

Web To lock a mortgage rate first be mindful of where you are in the loan process. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Get Started With Americas Largest Mortgage Lender Now And Learn Todays Rates.

Web This ensures you will have that rate when you get to your closing. Estimate Your Monthly Payment Today. When to lock your.

For that month analysts had forecast new jobs at 187000. Ad More Veterans Than Ever are Buying with 0 Down. Typically rate locks are only offered once you have a fully ratified sales contract.

Web A mortgage rate lock is when your lender guarantees to set your loan at a specific fixed rate even if market interest rates change before your loan closes. Web Locking in a mortgage rate protects you against rate hikes that lead to higher monthly payments and long-term costs especially during times of volatility. Ad Dedicated to helping retirees maintain their financial well-being.

We will extend your rate lock at no cost to you. Ad Calculate Your FHA Loan Payment Fees More with an FHA Mortgage Lender. A larger down payment can help you lock in a lower rate because it makes you a less risky.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Apply Online Get Pre-Approved Today. 583 up from 570 last week 013.

Save Time Money. Get Started With Americas Largest Mortgage Lender Now And Learn Todays Rates. That means you wont have to worry about the total cost of your home.

Ad Compare Best Mortgage Lenders 2023. Web A mortgage rate lock period could be an interval of 10 30 45 or 60 days. You may be able to.

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. See If You Qualify for Low Down Payment. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Web With a long-enough timeline mortgage rates can change drastically. The longer the period is could mean a higher interest rate is agreed upon. Web Because last months report for January was an extraordinary outlier.

Rates Over Time In 1981 the average 30-year mortgage rate was 1663. 51 ARM mortgage rate. At 45 percent the loan payment will be 2280 per.

Web The Feds actions contributed to a steady decline in mortgage rates where the average 30-year mortgage rate hit a low of 265 in Jan. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web A lock-in or rate lock on a mortgage loan means that your interest rate wont change between the offer and closing as long as you close within the specified.

See if you qualify. Locking a rate can protect you from swings in the market. 633 up from 622 last week 011.

Web 22 hours agoA mortgage rate lock guarantees that your interest rate wont change after making an offer. Ad With the Power of RateShield You Can Protect Your Self in a Rising Rate Environment. But the actual figure came in at.

Thirty years later in. Web If your rate lock will expire prior to closing and disbursement of funds a rate lock extension will be required to close your loan. Web Interest rates are unpredictable so if youve found a loan that meets your budget consider locking in the rate.

Check Official FHA Loan Requirements. Web 2 hours agoThe 30-year fixed-rate mortgage was 322 in early January 2022. Ad With the Power of RateShield You Can Protect Your Self in a Rising Rate Environment.

1 Conventional Fha Va Usda Purchase Loan Guide Top Rated Local Buildbuyrefi Home Loan Experts 1 Construction Renovation Cash Out Purchase Loan Experts Buildbuyrefi Com

Penny Wrightly S Last 10 Newsletters Hippocontact

Articles By Tag Holland Mi Five Star Real Estate Lakeshore Fivestar Lakeshore Blog

When Should You Lock In Your Mortgage Interest Rate Mortgage Blog

:max_bytes(150000):strip_icc()/when-is-the-best-time-for-a-loan-lock-1798435_V3-6fa09c5d98ed4023932ab8a6b299a68b.jpg)

How Locking The Interest Rate On A Mortgage Works

Mortgage Lock Rates Increased In February Why As Usa

Mortgage Rate Locks Everything You Need To Know Prevu

St George Page 10 Productreview Com Au

Rate Re Lock Fairwinds Credit Union

Mortgage Rate Locking Meaning When To Do It Mashvisor

When To Lock In Your Mortgage Interest Rate First Time Home Buyers New Builds Youtube

Should I Lock In My Mortgage Rate Sept 2022 Youtube

When Should You Lock In Your Mortgage Interest Rate Mortgage Blog

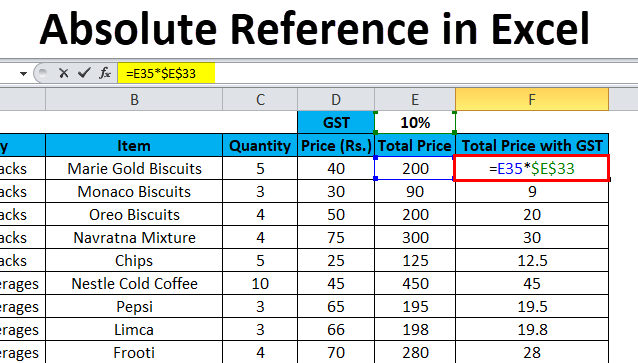

Absolute Reference In Excel Uses Examples How To Create

Mortgage Rates Are Going Up In 2022 Lock Your Mortgage Rate In Now While You Shop Urgent Youtube

Prices Of Existing Homes Fall 11 From Peak Sales Hit Lockdown Low Cash Buyers And Investors Pull Back Hard Wolf Street

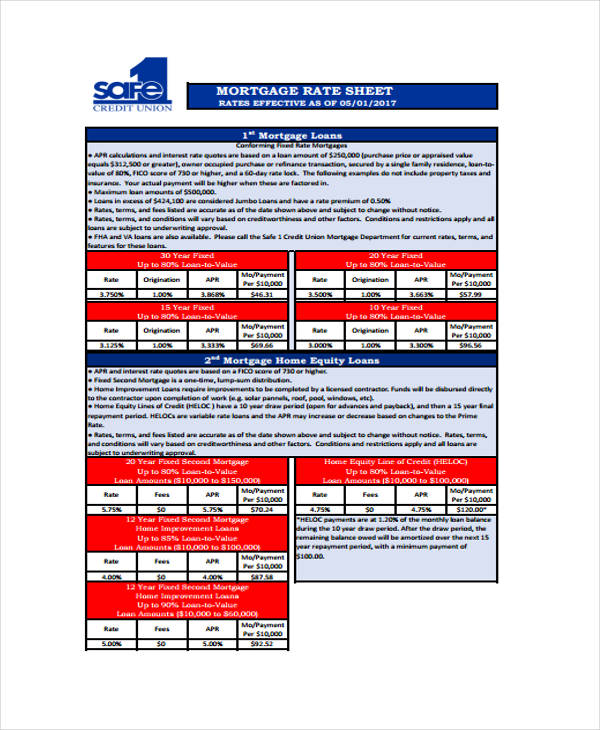

44 Sheet Examples Psd Ai Word Pdf