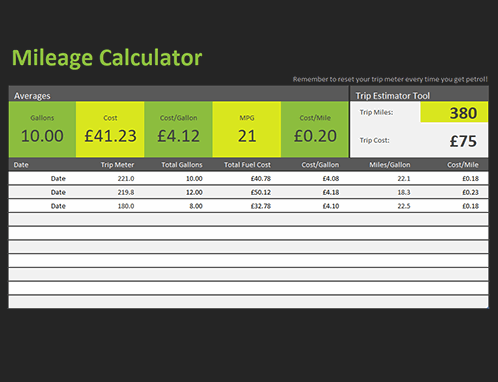

Calculate gas mileage reimbursement

Get total trip cost and mileage breakdown - mileage rate tracking mileage report gas tolls etc. The IRS sets a standard mileage reimbursement rate.

Figuring Your Tax Deduction After The Irs Boosts Mileage Rates

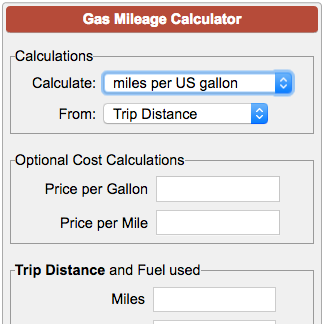

Select your tax year.

. Mileage reimbursement programs are best suited for companies with a smaller number of drivers in a specific location that drive no more than 5000 miles annually. Given the year 2022. Reimbursements based on the federal mileage rate.

A variable rate calculates mileage based on factors such as fuel efficiency driving time and vehicle. Enter the estimated MPG for the vehicle being driven. How do you calculate gas mileage reimbursement.

For example using 10W-30 motor oil in an engine designed to use 5W-30. Mileage Reimbursement Calculator instructions. The new rate for.

The current standard mileage rate is 585 cents per mile. To calculate your business share you would divide 100 by 500. In December of 2021 the IRS announced that the standard mileage rate for 2022 would be 585 cents per mile.

For 2020 the federal mileage rate is 0575 cents per mile. To determine what your business miles are worth multiply the miles driven by the mileage rate set by your employer. In those 500 miles you did 5 business trips that totaled 100 miles.

Click on the Calculate button to determine the. Step 2 Enter your miles driven for business purposes. Now lets say your employee uses a.

As for Q1 Q2 of 2022 this rate is 585 cents per mile you drive while between July 1 and December 31 2022 the federal business mileage rate is 625 cents per mile the. However on June 9th of 2022 they announced they would raise. The more cost-effective method will be highlighted.

Input the number of miles driven for business charitable medical andor moving purposes. If use of privately owned automobile is authorized or if no Government-furnished automobile is available. How do you calculate gas mileage reimbursement.

The tool will calculate the costs for both renting from Enterprise and reimbursing the employees mileage. Use latest IRS reimbursement rate for work medical. 11700 200 miles 585 cents.

Try Mileage Reimbursement Calculator. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. To find your reimbursement you multiply the.

Using a mileage rate The standard mileage rate is 56 cents per mile. A fixed rate allows a motorist to calculate their mileage based on the miles they drive. Enter applicable statelocal sales taxes and any additional feessurcharges.

Step 1 Select your tax year. To find your reimbursement you multiply the number of miles by the rate. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the.

Then add all three you will get the mileage reimbursement. Gas mileage will improve by 1 percent to 2 percent if you use the manufacturers recommended grade of motor oil. Your business mileage use.

Calculate the mileage reimbursement for the year 2022. Below is a simple reimbursement calculation using the standard IRS mileage rate. Rate per mile.

Step 3 Optionally enter your miles driven for moving. Miles rate or 175 miles. Reimbursement amount miles rate.

For example lets say you drove 224 miles last month and your employer. Enter the current mileage reimbursement rate.

2021 Mileage Reimbursement Calculator

Deductible Mileage Rate For Business Driving Increases For 2022 Sol Schwartz

Mileage Calculator

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

How To Calculate Mileage Reimbursement Guide To Deductions

Gas Mileage Calculator

Mileage Calculator Credit Karma

Irs Mileage Rate For 2022

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Mileage Log Template Free Excel Pdf Versions Irs Compliant

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

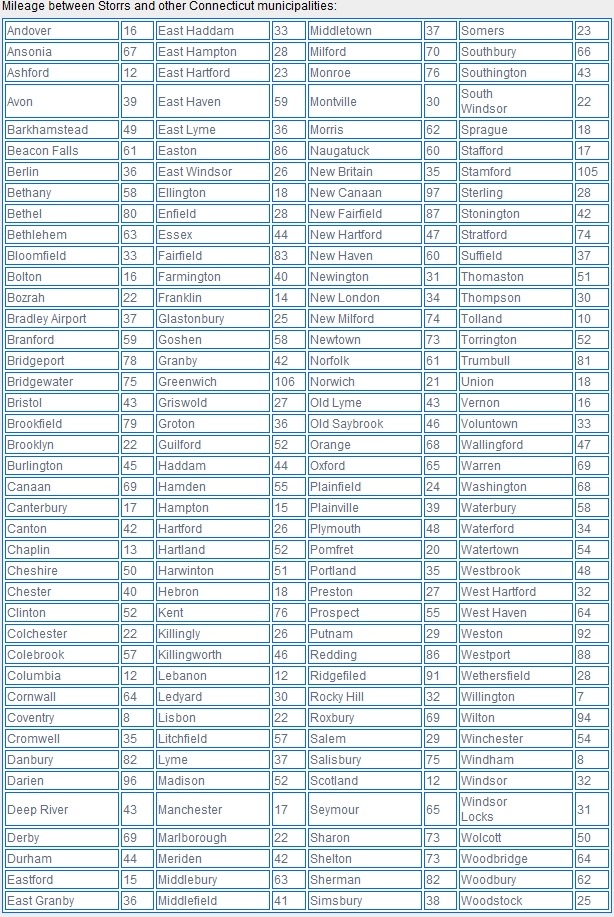

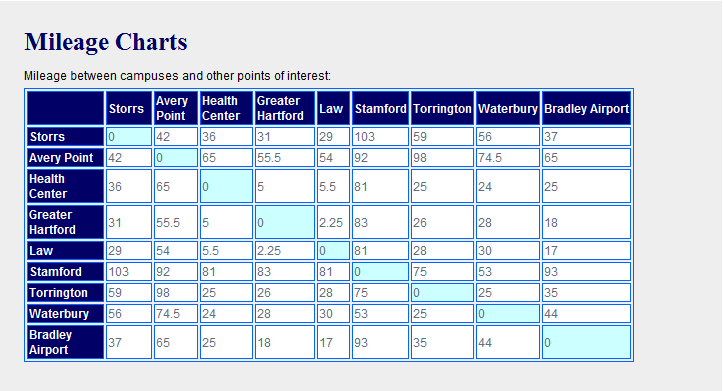

Mileage Calculation Accounts Payable

Company Mileage How Are Mileage Rates Determined

Use Our Rate Calculator To Budget For Mileage Reimbursement Costs

Mileage Reimbursement Calculator

Mileage Calculation Accounts Payable